On the other hand, if you’re considering a financial debt consolidating loan from SoFi, Remember the fact that the lender doesn't present immediate payment to a borrower’s other creditors. What this means is the loan proceeds might be deposited to your bank account therefore you’ll have to pay off your other lenders separately.

So within the pretty minimum, it’s well worth considering how the most well-liked personal debt remedies Examine and use to your condition.

Sally Lauckner has about ten years of working experience in print and on the net journalism. In advance of becoming a member of NerdWallet, Sally was the editorial director at Fundera, the place she built and led a team centered on small-small business content material. Her prior working experience involves two decades as a senior editor at SmartAsset, the place she edited a wide range of personalized finance content, and five years on the AOL Huffington Write-up Media Group, in which she held a range of editorial roles.

Bill factoring will involve selling unpaid client invoices into a factoring enterprise that then collects The cash from the prospects.

We do not provide economic suggestions, advisory or brokerage companies, nor do we suggest or advise individuals or to obtain or provide individual stocks or securities. Functionality data could have altered Considering that the time of publication. Previous efficiency isn't indicative of future results.

The appropriate particular loan can provide competitive premiums, negligible service fees and an affordable timeline for repayment. Although not all own loans characteristic great terms, and it could be hard to find the lender that’s the correct fit for your needs.

At that point, the damage from delinquency will currently be carried out, and your top fears will be a collections account and a lawsuit. Both are bad for your credit history rating, but both equally can be avoided by repaying more info quantities owed.

Before you acquire out a $five,000 particular loan with poor credit rating, recognize that the lender might be concerned about the level of threat involved with the transaction. Subsequently, you might have to pay larger curiosity premiums and costs to offset that risk before the lender will approve your loan application.

These loans are attainable that has a credit score score of 450 since they require collateral the lender can keep when you default around the loan, so you will find comparatively minimal threat for that lender.

Keep in mind, this is kind of distinctive from a standard fund framework, which draws capital around the motivation time period. Additional, from the liquidity standpoint, evergreen structures typically present traders a chance to redeem as many as 5% in their net asset price per quarter, offering investors increased Manage around liquidity as compared to regular fund structures. Also, these automobiles purpose to distribute earnings consistently.

Compile all of the necessary paperwork. The files required to make an application for a private loan differ by lender but commonly consist of your driver’s license, Social Protection number, proof of cash flow and handle.

Lenders use credit rating scores to help assess how risky they Feel you're going to be to lend to. A weak credit rating could be an indication that you’ve experienced some earlier credit history worries, which include late or discharged payments, accounts in collections or a individual bankruptcy, or you have minimal to no credit history heritage.

Naturally, the features on our System don’t stand for all monetary items around, but our purpose will be to tell you about as many great choices as we are able to.

Test your credit history rating. Borrowers using a credit history score of at least 670 usually tend to get approved for a personal loan than less creditworthy applicants. Using a powerful credit score record also makes it simpler to qualify which has a lender that offers accelerated funding speeds with competitive premiums.

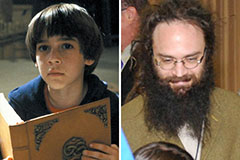

Barret Oliver Then & Now!

Barret Oliver Then & Now! Ben Savage Then & Now!

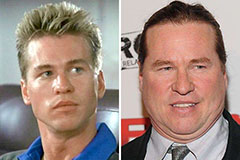

Ben Savage Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!